The Rocket Refinance Calculator: Your Guide to Refinancing

Table Of Content

It usually takes 30 to 45 days on average; however, it can be as long as two months if you run into any issues during the application and underwriting process. The results of this calculator explain which one of the above categories your refinance would fit into. TermThe number of years you have to repay your loan (often 30 or 15 years).

What Is the Break-Even Point on a Mortgage?

Idaho Mortgage Calculator - The Motley Fool

Idaho Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

You can use the best estimate to negotiate with other lenders, which might result in getting a lower rate or reducing certain administrative fees. There are also no credit score minimums for USDA or VA refinances; however, lenders might apply their own standards to these refinances. Avoid applying for new lines of credit before you apply for a mortgage refinance, as credit applications can bring down your score.

Get a more accurate estimate

Typically, when you belong to a homeowners association, the dues are billed directly, and it's not added to the monthly mortgage payment. Because HOA dues can be easy to forget, they're included in NerdWallet's mortgage calculator. To find the best cash-out refinance lender for your needs, it’s important to shop around and compare your options from as many of them as possible, including your current mortgage lender. Consider not only interest rates but also repayment terms, any fees charged by the lender and eligibility requirements. Cash-out refinancing isn’t the only way to tap into your home equity. You could also consider a home equity line of credit (HELOC) or a home equity loan.

How do I qualify for refinancing?

Before you refinance your home, you should shop around for a lender that will offer you the best rate and repayment terms that suit you. These companies offer some of the most competitive rates and low fees, which are key criteria for refinancing. You can bump up your credit score by paying off credit card debt and reducing how much you use your cards. If you do use credit cards for rewards and points, try to pay them off immediately—don’t wait for your monthly statement to come in because your score can change daily.

How to calculate mortgage payments

A balance transfer is a process of transferring high-interest debt from one or more credit cards to another card with a lower interest rate. The maximum amount of debt consolidated will depend on the new line of credit. Shorten the Loan—Borrowers can potentially pay off their existing loans faster by refinancing to shorter loan terms. One of the most common examples is refinancing a 30-year mortgage to a 15-year mortgage, which typically comes with a lower interest rate, though this will most likely result in a higher monthly payment.

Mortgage Rates Today: April 16, 2024—15-Year and 30-Year Mortgage Rates Move Up - Forbes

Mortgage Rates Today: April 16, 2024—15-Year and 30-Year Mortgage Rates Move Up.

Posted: Tue, 16 Apr 2024 07:00:00 GMT [source]

Conforming loans

If you’ve looked at the numbers and decided that refinancing makes sense, then it’s time to shop around for a refinance lender. Check with your current mortgage servicer, as well as national banks, credit unions, online mortgage lenders and possibly a mortgage broker to compare refinance rates and terms. Use a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. Divide the breakeven timeframe (months) by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. If you plan to sell before the breakeven point, it is probably not financially worth it to refinance. A key consideration when deciding whether to refinance a mortgage is when you’ll break even on your costs.

If both the monthly payment and interest will be higher

In the U.S., private student loans are generally not as flexible as federal loans, so refinancing the private student loan may result in a lower payment. Typically, private student loans, Grad PLUS loans, and Parent PLUS loans are most likely to benefit from being refinanced, since they usually have higher interest rates. For example, if you have an adjustable-rate mortgage (ARM) and the rate is about to increase, you can change to a more stable fixed-rate mortgage. Monitor refinance rates regularly and use Zillow’s free refinance calculator to make sure a refinance is worth it for your financial circumstances. It depends not only on your own current financial situation, but also on the general financial climate.

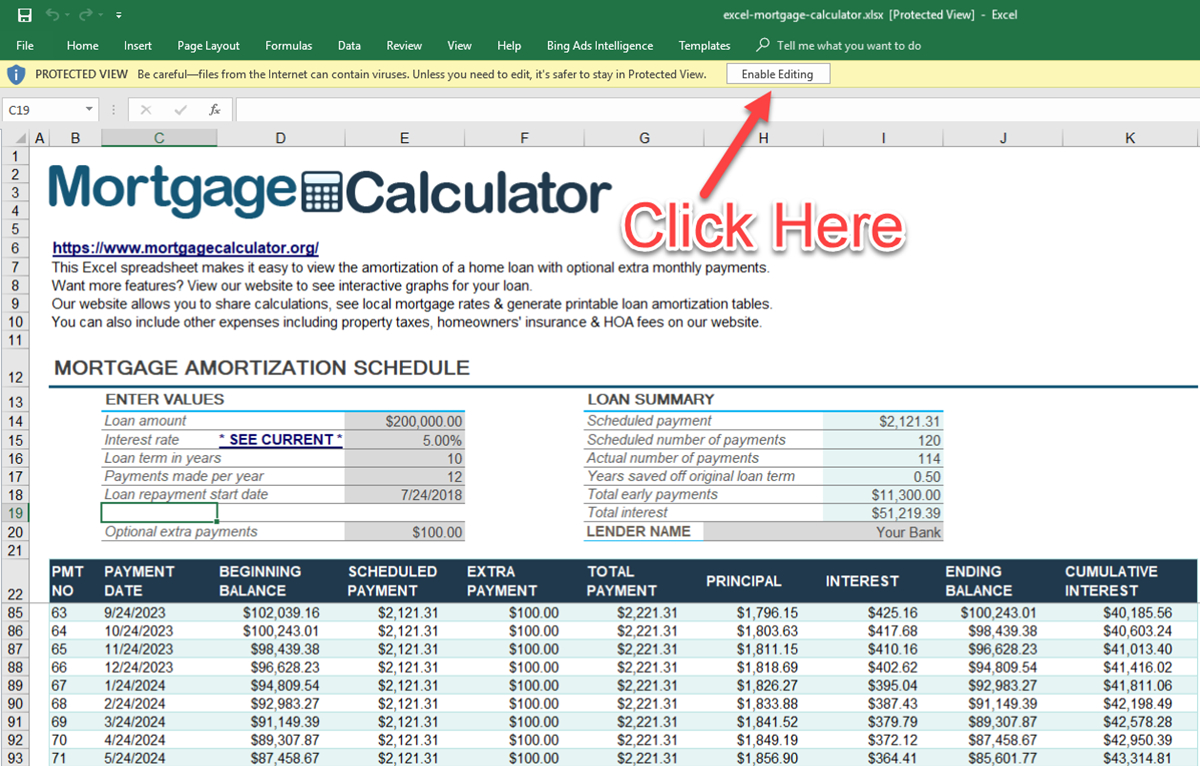

Likewise, if you already have a relationship with another bank, it can likely streamline the application process and provide more favorable terms. To calculate the value of refinancing your home, compare the monthly payment of your current loan to the proposed payment on the new loan. Then use an amortization schedule to compare the principal balance on your proposed loan after making the same number of payments you’ve currently made on your existing loan. Both the monthly payment and principal balance of the new loan should be lower. Enter your specific details into the refinance calculator above for a detailed savings breakdown. Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options.

Learn About Mortgages

You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you don’t wish to use NerdWallet’s estimates. It can depend on the lender, but you won’t get the money at closing. Federal rules give borrowers a three-day rescission period in which you can change your mind and cancel the mortgage.

Cash-out refinancing can be a good option for homeowners looking to tap into their home equity. With this calculator, you can see what your monthly payment and overall cost would look like with a cash-out refinance. The major part of your mortgage payment is the principal and the interest.

Currently, 30-year mortgage rates are above 7%, according to Zillow data. When you’re shopping around, be sure to ask about any discounts—including appraisal waivers—that might be available to you. Some financial institutions offer discounts to existing customers; you might also find military discounts. Finally, the lower your loan-to-value (LTV) ratio is, the lower your interest rate will be. If you don’t have to take cash out of your home when you refinance, you might want to avoid doing so as that will bump up your LTV and likely result in a higher interest rate.

As you move the slider left and right, the calculator updates your total savings over the indicated number of years. The calculator includes interest paid, plus the estimated closing costs. If interest rates have dropped, or your credit score has improved, you may be able to get better home loan terms by refinancing. The total monthly payment includes mortgage principal, interest, taxes, insurance, and HOA fees, if applicable.

The application process to refinance a personal loan will take into account the borrower's credit history and score, as well as their debt-to-income ratio. For more information about or to do calculations involving personal loans, please visit the Personal Loan Calculator. If you have enough equity in your home, you may be able to do a cash-out refinance. With cash-out refinancing, you refinance your current home loan for more than the amount you currently owe and keep the extra money to spend on things like home projects or paying off other high-interest debt. In the "advanced settings" on the refinance calculator you can convert the tool to a cash-out refinance calculator. Most lenders allow you to roll the closing costs of the refinance into the balance of your new loan, increasing the total amount borrowed.

With a reverse mortgage, homeowners aged 62 or older (or 55 and older, depending on lender) who have paid off their mortgage or have substantial equity receive tax-free income based on their home’s equity. These funds can be used for a variety of purposes, such as supplementing retirement income, paying for home repairs or covering medical expenses. A no-closing cost refinance is best if you want to refinance but don’t have the cash to cover closing costs. You’ll refinance your mortgage the same way you would with a rate-and-term refi, only to a bigger loan amount based on how much equity you plan to tap. In general, refinancing is worth it if you can save money or if you need to access equity for emergencies. FHA streamline refinance loans also require an upfront mortgage insurance premium (MIP) of up to 1.75% of the base loan amount, plus an annual MIP of up to 1.05% of the base loan amount.

Comments

Post a Comment